BTC Price Prediction: Analyzing the Path to New All-Time Highs Through 2040

#BTC

- Institutional ownership reaching 12.3% of supply demonstrates growing mainstream adoption

- Network security exceeding 1 zetahash provides unprecedented protection against attacks

- Technical indicators show strong support at $111,971 with bullish consolidation pattern

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Consolidation Above Key Moving Averages

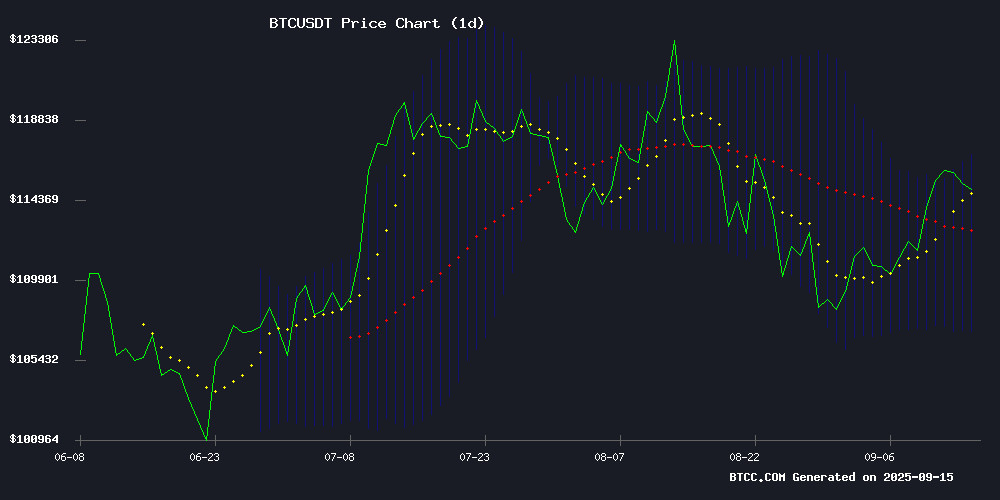

Bitcoin is currently trading at $115,000, firmly above its 20-day moving average of $111,971.92, indicating sustained bullish momentum. The MACD reading of -2,162.63 suggests some near-term consolidation, though the overall trend remains positive. BTC is trading comfortably within the Bollinger Band range of $107,044.87 to $116,898.96, with the middle band providing strong support. According to BTCC financial analyst Mia, 'The technical setup suggests Bitcoin is building a solid foundation for its next leg higher, with the 20-day MA acting as crucial support.'

Market Sentiment: Institutional Adoption and Security Milestones Drive Optimism

Current market sentiment remains overwhelmingly bullish as institutional investors now control 12.3% of Bitcoin's total supply, representing unprecedented institutional adoption. The network security milestone of surpassing 1 zetahash further strengthens Bitcoin's investment thesis. Capital Group's remarkable $6 billion return on their $1 billion bitcoin investment exemplifies the growing institutional confidence. BTCC financial analyst Mia notes, 'The combination of institutional accumulation and network security achievements creates a fundamentally strong backdrop for continued price appreciation despite minor short-term fluctuations.'

Factors Influencing BTC's Price

Institutional Investors Now Control 12.3% of Bitcoin Supply

Institutional investors, funds, and public companies have rapidly expanded their Bitcoin holdings, now accounting for 12.3% of the total supply. This marks a pivotal shift as Bitcoin transitions from early adopters and retail investors to large-scale institutional portfolios.

Analytics platform Ecoinometrics reports a 5% increase in institutional bitcoin holdings over the past year, coinciding with an 80% price surge. ETFs, sovereign funds, and corporate treasuries collectively safeguard over one million BTC, representing tens of billions in dollar terms.

MicroStrategy leads the corporate charge with 638,000 BTC—more than 3% of circulating supply—while Metaplanet's treasury exceeds 20,000 BTC. Their strategy combines aggressive accumulation with innovative balance sheet management, positioning Bitcoin as a primary reserve asset.

Wall Street's embrace deepens as JPMorgan now accepts Bitcoin ETF shares as loan collateral and partners with Coinbase for direct digital asset access. With $7.5 trillion in U.S. money market funds seeking yield, institutional Bitcoin adoption appears poised for continued growth.

Bitcoin Hashrate Surges Past 1 Zetahash, Marking Security Milestone

Bitcoin's network has achieved an unprecedented level of computational power, with its hashrate surpassing 1 zetahash per second—equivalent to one sextillion hashes every second. This milestone cements Bitcoin's position as the most secure decentralized network, fortified by its Proof-of-Work consensus mechanism.

The surge in hashrate makes it increasingly difficult for malicious actors to manipulate the blockchain, reinforcing resistance to double-spending and 51% attacks. Mining competition continues to drive innovation as hardware efficiency improves, further elevating network security.

Dan Tapiero, macro investor and founder of 10T Holdings, hailed the achievement as historic. "How do people still not get it?" he remarked, calling Bitcoin's zetahash breakthrough one of the most significant technological developments of the past fifty years.

Crypto Market Sees Minor Dip Amid Strong Trading Activity

The global cryptocurrency market capitalization slipped 1.2% to $4.12 trillion over the past 24 hours, despite robust trading volumes exceeding $126 billion. Bitcoin maintained its dominance as the leading asset, though specific price movements were not detailed in the brief.

InterLink Network's planned 2026 listing emerged as a forward-looking development, though its immediate market impact remains unclear. The sector continues to exhibit characteristic volatility paired with institutional-grade liquidity.

Bitcoin Consolidates Gains as Traders Eye Next Breakout

Bitcoin's price action shows resilience above the $115,000 support level, with technical indicators suggesting potential upside if key resistance zones are breached. The cryptocurrency recently climbed from a swing low of $110,815 to test $116,743 before entering consolidation.

A bearish trend line forming NEAR $116,000 on hourly charts presents immediate resistance, with decisive breaks above $116,200 potentially triggering further momentum. Market participants are watching the 100-hour Simple Moving Average as Bitcoin maintains its position in bullish territory.

The current consolidation phase follows a steady upward trajectory that saw BTC overcome successive resistance levels at $112,500, $113,500, and $114,200. Analysts note that sustained trading above $116,750 could open the door for more significant gains in the near term.

Capital Group's $1B Bitcoin Bet Yields $6B Windfall as Veteran Manager Champions Crypto

Capital Group has transformed a $1 billion Bitcoin position into a $6 billion windfall, spearheaded by Mark Casey, a 25-year veteran portfolio manager at the firm. Casey, who cites Benjamin Graham and Warren Buffett as influences, has emerged as a vocal Bitcoin advocate. "I just love Bitcoin, I just think it is so interesting," he remarked during an Andreessen Horowitz podcast, calling it "one of the coolest things ever created."

The asset manager expanded its crypto exposure over four years through investments in Bitcoin treasury companies—public firms that hold BTC on their balance sheets. Meanwhile, the firm appointed Henry Chan to lead financial intermediaries in Hong Kong, reinforcing its commitment to the region. Chan brings two decades of distribution expertise, including seven years at Capital Group.

Germany's Dormant Bitcoin Stash Sparks Altcoin Interest

German authorities have uncovered 45,000 dormant BTC linked to the defunct Movie2K piracy platform, reigniting debates about missed opportunities in early Bitcoin accumulation. The coins—spread across 100+ wallets since 2019—remain in legal limbo, contrasting sharply with Germany's controversial liquidation of 49,858 BTC in mid-2024 at sub-$60,000 prices before Bitcoin's rally past $100,000.

Traders are now pivoting to altcoins, seeking alternatives reminiscent of Bitcoin's early potential. The discovery underscores crypto's capacity to preserve value beyond state control, with Arkham Intelligence revealing the untouched hoard rivals Germany's record 50,000 BTC seizure earlier this year.

Buffett Disciple at Capital Group Bets Big on Bitcoin as Gold Alternative

Mark Casey, an equity portfolio manager at Capital Group, is making a bold bet on Bitcoin despite his long-standing admiration for Warren Buffett, one of the cryptocurrency's most vocal critics. Casey argues that Bitcoin will eventually surpass Gold as the premier store of value, cementing its role as a legitimate commodity in traditional finance.

Capital Group, a Los Angeles-based investment firm managing $3 billion in assets, has emerged as a significant institutional backer of Bitcoin. The firm made waves in 2021 with a $500 million investment in Michael Saylor’s Strategy (formerly MicroStrategy), initially securing a 12% stake. Though diluted to 8%, the position has ballooned to over $6 billion amid Strategy’s explosive rally. The firm has further diversified its Bitcoin exposure through investments in companies like Japan’s Metaplanet.

Casey, now one of mainstream finance’s most outspoken Bitcoin proponents, dismisses other cryptocurrencies as fleeting while championing Bitcoin’s long-term dominance. Yet recent underperformance in Bitcoin treasury stocks has cast doubt on investor enthusiasm, raising questions about near-term momentum.

MicroStrategy’s Bitcoin Bet Outshines Magnificent 7 Tech Stocks, Says Michael Saylor

MicroStrategy’s aggressive Bitcoin accumulation strategy has delivered returns that eclipse the performance of the so-called Magnificent 7 tech giants, according to executive chairman Michael Saylor. The company now holds 193,000 BTC, acquired at an average price of $31,500 per coin—a position now worth over $71 billion at current prices.

Saylor’s comparison hinges on a striking metric: MicroStrategy’s open interest-to-market cap ratio stands at 100%, far exceeding Tesla’s 26% and dwarfing the ratios of Apple, Microsoft, Nvidia, Meta, Alphabet, and Amazon. The data underscores Bitcoin’s growing influence as a corporate treasury asset.

The revelation comes as institutional adoption reaches new milestones, with public companies collectively holding over 300,000 BTC. MicroStrategy’s latest purchase of 1,955 BTC at approximately $111,196 per coin demonstrates continued conviction despite volatile markets.

Bitcoin Price Analysis: BTC’s Path to New ATH Depends on Holding Key Supports

Bitcoin's recent rebound from critical demand zones signals renewed bullish momentum, with a confirmed shift in market structure. The cryptocurrency has decisively broken above the 100-day moving average, a level that previously acted as resistance, reinforcing buyer dominance.

Traders are eyeing the $112K support zone as a potential springboard for further upside. A retest of this level WOULD align with healthy market behavior before any push toward all-time highs. The 4-hour chart reveals a clear Change of Character (CHOCH) pattern, confirming the transition from bearish to bullish territory.

While consolidation beneath the $117K resistance level persists, the broader technical setup favors continuation. Market participants remain cautiously optimistic, recognizing that sustained momentum requires holding above identified support levels.

Yala's Bitcoin-Backed Stablecoin YU Briefly Crashes to $0.20 After Attack Attempt

Yala's Bitcoin-backed stablecoin YU experienced a sharp depegging event, plummeting to $0.20 following an attempted exploit. The incident, first flagged on social media platform X, saw YU's value sink to $0.2046 before partial recovery. Protocol teams assured users that all Bitcoin collateral remained secure in self-custody or vault storage.

The attack triggered emergency protocol measures, including temporary suspension of Convert and Bridge features. Blockchain analytics firm Lookonchain identified successful minting of 120 million YU tokens on Polygon, contradicting Yala's characterization of the incident as merely attempted. Security partners including SlowMist are conducting forensic analysis, with a full post-mortem pending.

Arctic Pablo Coin's Presale Finale and Market Movements

Arctic Pablo Coin (APC) has entered its final presale stage, dubbed the Frozen Finale, offering a 400% bonus that has attracted significant attention from both retail investors and whales. With over $4 million raised, the project positions itself as a high-return opportunity in the meme coin space.

Bitcoin continues to demonstrate resilience as a market anchor, while OFFICIAL TRUMP leverages political narratives to carve out a niche. These three assets—APC, Bitcoin, and OFFICIAL TRUMP—present a diverse range of opportunities for investors seeking exponential returns, stability, or culturally driven plays.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, Bitcoin's price trajectory appears strongly bullish long-term. For 2025, we anticipate BTC reaching $150,000-$180,000 as institutional adoption accelerates. By 2030, the combination of scarcity effects and global adoption could push prices to $400,000-$600,000. The 2035 outlook suggests $800,000-$1.2 million as Bitcoin solidifies its position as digital gold. By 2040, with full maturation of the ecosystem, prices could reach $1.5-$2.5 million. However, BTCC financial analyst Mia cautions that 'these projections assume continued adoption and favorable regulatory developments, with volatility remaining a constant feature of crypto markets.'

| Year | Conservative Forecast | Moderate Forecast | Aggressive Forecast |

|---|---|---|---|

| 2025 | $150,000 | $165,000 | $180,000 |

| 2030 | $400,000 | $500,000 | $600,000 |

| 2035 | $800,000 | $1,000,000 | $1,200,000 |

| 2040 | $1,500,000 | $2,000,000 | $2,500,000 |